eCommerce: Fashion & Sustainability Initiatives

H&M Online Strategy: Diversifying Its Brand Portfolio

H&M's affordable, trendy clothing has driven its global success. Yet, changing market conditions are pushing the company to adjust. Here is a look at what these changes are and how they are expected to influence H&M's bottom line.

Article by Nadine Koutsou-Wehling | January 05, 2024

H&M's Business Strategy: Key Insights

Adjusted Brand Portfolio: To counter negative associations with fast fashion, the H&M Group has diversified its portfolio, incorporating brands like COS, & Other Stories, and ARKET, emphasizing quality at higher prices.

Sustainability Issues: Through the acquisition of Sellpy and Afound, H&M Group provides contemporary solutions to the challenges of fast fashion. Sellpy operates as a secondhand marketplace, while Afound offers surplus items from both H&M's own brands and third-party labels.

Facing Competition in Online Fashion: Online rivals like Shein are experiencing rapid growth, posing challenges for traditional fashion retailers. H&M, Zalando, and Zara, as they address the balance between sustainability and affordability, trendiness and circularity, are diversifying their offerings and adjusting strategies.

Most of us are familiar with H&M, either as consumers or by passing its stores on the high street: The brand is popular with a wide range of shopper demographics, thanks to frequently changing styles based on the latest fashion trends at affordable prices.

Efficient supply chain management, which facilitates cost-effective and rapid product distribution, is a fundamental aspect of H&M's business model. However, the brand has recently faced increased scrutiny, exacerbated by the emergence of online-only competitors that undercut established fashion retailers.

H&M is one of the companies that has reacted to criticisms and made adjustments to the way it does business. This insight discusses what changes the company has made, and whether they are truly indicative of a transition to more responsible business practices.

The H&M Group Comprises Nine Brands

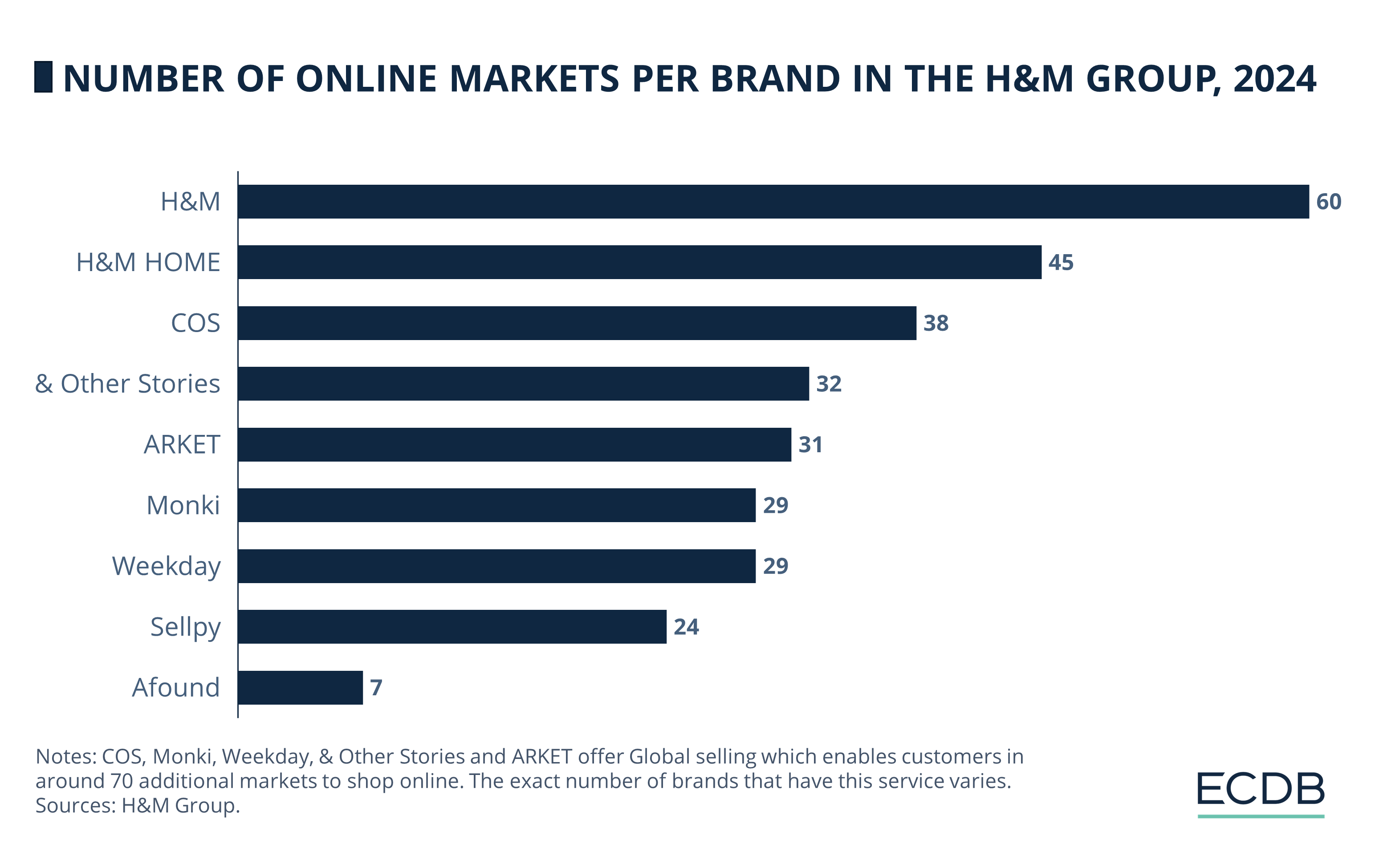

H&M operates in 77 markets around the world, 60 of which have an online presence. In addition, the H&M Group includes several fashion brands, each with their own unique style. These additional brands include COS, Monki, Weekday, & Other Stories, ARKET, Afound, H&M HOME, and Sellpy.

The number of markets where each of these brands sells online is shown below.

H&M itself is present in 60 online markets, the highest number of all subsidiaries. This is followed by H&M Home with 42 markets. COS, a brand that offers more minimalist styles at higher prices, sells online in 38 markets, while & Other Stories operates in 32. ARKET follows closely with 31 online markets, while Monki and Weekday both operate online in 29 markets. Sellpy, an exclusively online brand, is active in 24 markets, while Afound is the brand with the lowest online presence.

These statistics show us that the H&M Group is not only active in a large number of countries, but also offers a variety of brands for a wide range of different tastes and economic circumstances. Let's see how this manifests itself in terms of online net sales the Group generated in recent years.

H&M Group: Recovery After Pandemic Downturn

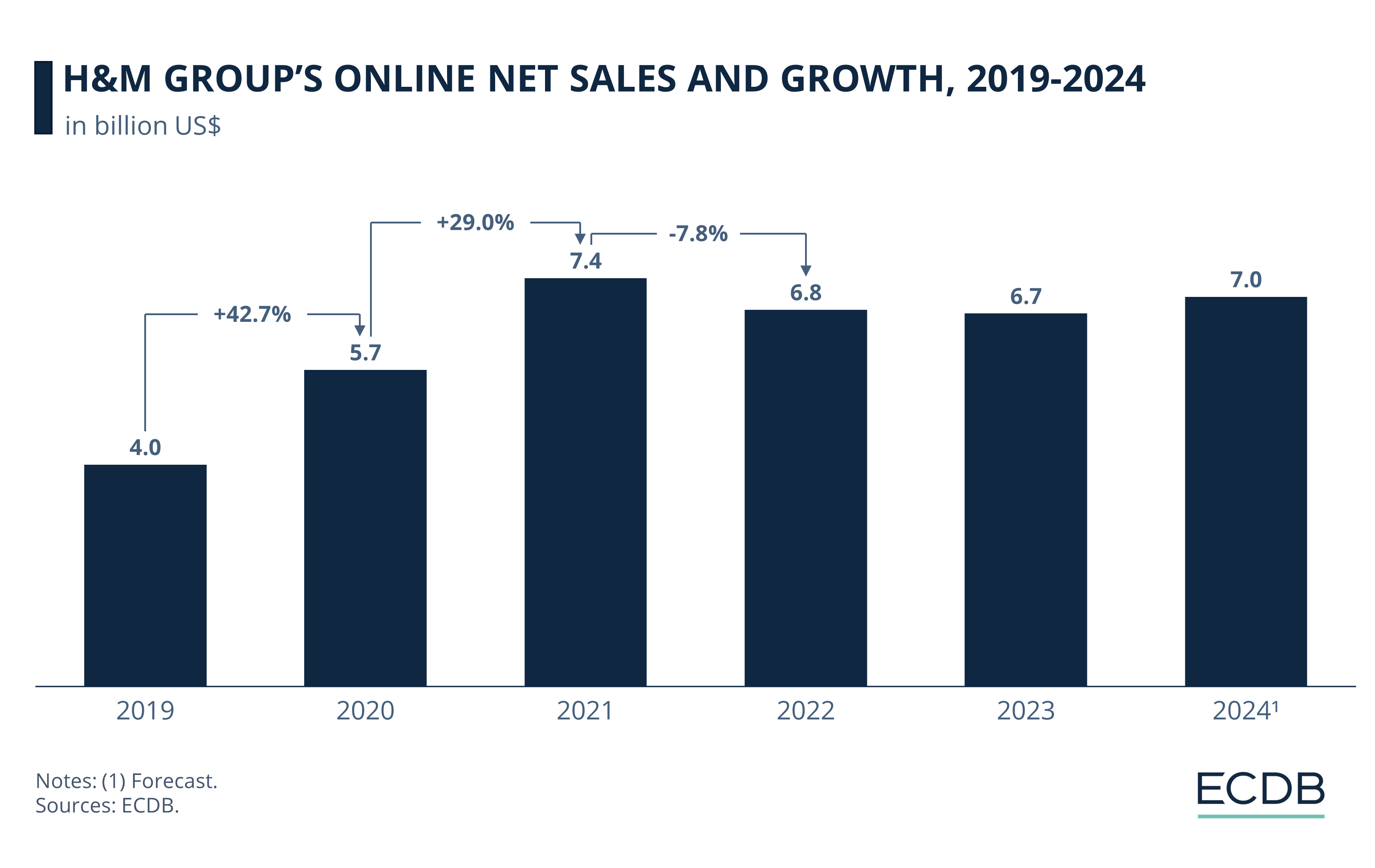

Company-wide online net sales, which include all of the nine brands described above, illustrate the devastating effect of the pandemic on business. This impact is most evident in the decline in sales experienced by the H&M Group in 2020, when online net sales fell by 17.5% to just overUS$20 billion.

Despite the full impact of the pandemic from 2020 to 2021, H&M Group managed to grow again. The Group therefore increased online net sales by US$3 billion in one year to US$23.2 billion in 2021, a 14.3% recovery from the previous year. With revenues stabilizing again in 2022 at a growth rate of 2.6%, it appears that the company's restructuring and diversification initiatives have achieved their goal.

Learn More About ECDB Store Rankings

So what exactly are these changes that the H&M Group is implementing with its variety of brands? The next section discusses this question in more detail.

New Portfolio: Focus on Quality and Circularity

The expansion of its portfolio has helped the H&M Group in terms of additional sales and in determining the direction of the overall brand identity. As its flagship brand H&M has recently come under fire for business practices that are commonly subsumed under the fast fashion umbrella, the inclusion of different brands with a distinct focus serves as a shift towards more durable offerings.

New Innovations to Other Brands in H&M's Portfolio

COS, & Other Stories, and ARKET prioritize quality items at higher price points, whereas Sellpy and Afound introduce a novel concept aligning with the growing emphasis on sustainability.

Sellpy is an online platform for secondhand goods, which was acquired by the Group in 2019. By contributing to the concept of a circular economy, it is expected to drive the movement towards more ecologically friendly business practices. Similarly, Afound’s concept focuses on the resale of overstocked products from the H&M Group’s own brands as well as other labels. At discounted prices, Afound is described as an outlet store for items that have not been sold at their original price or have been taken out of stock for other reasons, such as delivery mishaps or store issues.

Monki and Weekday, which cater to a younger demographic, are similar to H&M in terms of their affordable price strategy and rapid style cycles. But could it be that the fast fashion label is outdated for these brands? Recent company updates suggest that this may be the case.

Third-Party Brands and ReCommerce

Arguably the biggest change to its platform is the transformation of hm.com into a marketplace that includes third-party products from brands such as Adidas and New Balance.

The reason for including external brands is that the H&M Group wants to move away from its fast fashion reputation by adding more expensive elements to its product range. This should not only attract more customers, but also help the included brands reach a wider audience than before, especially when it comes to local players and newcomers.

Market Circumstances Led H&M Group to Act

H&M is under pressure to act, not only because of the recent criticism of its business practices, but also because its competitors have adjusted their strategies according to shifting market conditions. While Shein has also added third-party brands to its retail platform, Inditex’s Zara has raised prices in response to growing calls for higher costs in exchange for better quality.

The final section examines the competition among the above fashion brands in more detail, using past and projected eCommerce net sales for leading online fashion platforms.

Shein Outgrew H&M, Zara and Zalando

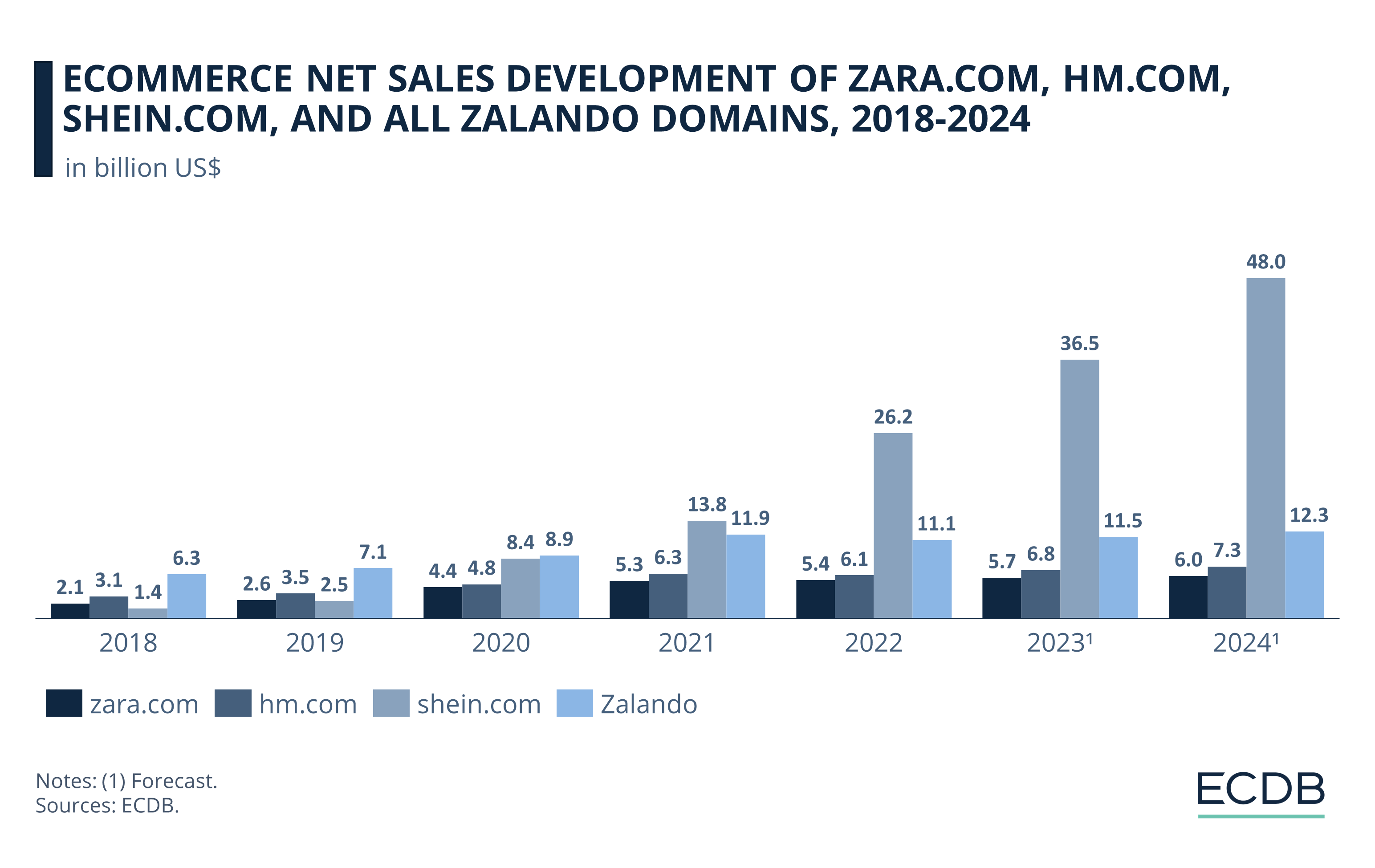

A direct comparison reveals several trends. First, the Covid-19 pandemic boosted online sales for all four platforms, with year-over-year growth of 37.1% for H&M, 69.2% for Zara, 25.4% for Zalando, and a whopping 236% for Shein in 2020.

Second, Shein’s revenue outpaces the other two companies by a staggering margin, with a compound annual growth rate (CAGR) of 80.7% from 2019 to 2024. While H&M and Zara are projected to reach online net sales of US$7.3 billion and US$6 billion, respectively in 2024, Shein’s figure is projected at US$48 billion. Of course, H&M and Zara also have physical sales in their brick-and-mortar retail stores, but with Shein’s recent acquisition of bankrupt fashion brand Forever 21, its physical presence is expected to expand accordingly.

The data shows the immense competition H&M faces now and in the years to come. The H&M Group's decision to adjust and diversify its brand portfolio with a different corporate identity comes at a critical time for the fashion conglomerate. It may determine its future course in the industry.

H&M's Business Strategy: Concluding Remarks

The Swedish multinational clothing company H&M is adjusting its business approach in response to criticisms and evolving market conditions. These changes involve emphasizing quality and sustainability through the H&M Group's subsidiary brands and featuring third-party products on its online marketplace.

Sources: Creative Supply - Fashion Network - H&M Group - Lilli Pyykkö - Modern Retail - Reuters

Related insights

Article

Fast Fashion is Changing eCommerce in Europe

Fast Fashion is Changing eCommerce in Europe

Article

Birkenstock Business Model: eCommerce Sales, Market Dynamics & Trends

Birkenstock Business Model: eCommerce Sales, Market Dynamics & Trends

Article

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

eCommerce Market in Europe 2024: On Its Way to 1 Trillion Dollars

Article

Fashion eCommerce Market in Asia: The Market Could Hit US$1.1 Trillion By 2025

Fashion eCommerce Market in Asia: The Market Could Hit US$1.1 Trillion By 2025

Article

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Amazon's Top Competitors in the UK: GMV, Product Categories & Annual Growth

Back to main topics